BioHealth News

Saving the Date for the 12th Annual BioHealth Capital Region Week

The BioHealth Capital Region continues to grow as one of the nation’s leading biohealth clusters, driven by research excellence, capital access, federal partnerships, and…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part VI

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence As we conclude our Optimizing Launch Messaging series, we’ve explored…

Read MoreStrengthening Concussion Diagnosis and Prognosis with Emergency Medicine Researchers Dr. Frank Peacock and Dr. Damon R. Kuehl of BrainBox Solutions, Inc. on BioTalk

Dr. Frank Peacock and Dr. Damon R. Kuehl join BioTalk for a focused discussion on one of emergency medicine’s most persistent challenges: accurately diagnosing…

Read MoreNearly 200 Episodes In. The BioTalk With Rich Bendis Podcast Wants Your Guest Suggestions

BioTalk with Rich Bendis wants to hear from its audience about the voices that deserve the mic. A new guest submission form is now…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part VI

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence To recap, the first 5 posts of our series covered:…

Read MoreThanking Jarrod Borkat and Rachel Rath for Their Service on the BioHealth Innovation Board

BioHealth Innovation extends its sincere thanks to Jarrod Borkat, Chief Commercial and Strategy Officer at On Demand Pharmaceuticals, and Rachel Rath, Head of JLABS…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part V

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence Welcome to Tactic 5 in our series of 7 Tactics…

Read MoreSSTI Profile: BHI’s Rich Bendis on Building and Scaling Innovation Ecosystems

The article below was originally developed by the State Science & Technology Institute (SSTI), a national nonprofit organization that works with states, regions, and practitioners…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part IV

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence In our last three posts of this series, we discussed:…

Read MoreBHI’s Top 10 BioHealth Capital Region Stories of 2025

The BioHealth Capital Region closed out 2025 with clear evidence of strength and momentum. While life sciences companies across the country navigated capital constraints,…

Read MoreFrom Can to Should: Reassessing Viability in 2026

Last year, I wrote a LinkedIn Article titled “To be or not to be: Just because you CAN, doesn’t mean you SHOULD.” The point…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part III

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence In our last two posts of this series, we discussed:…

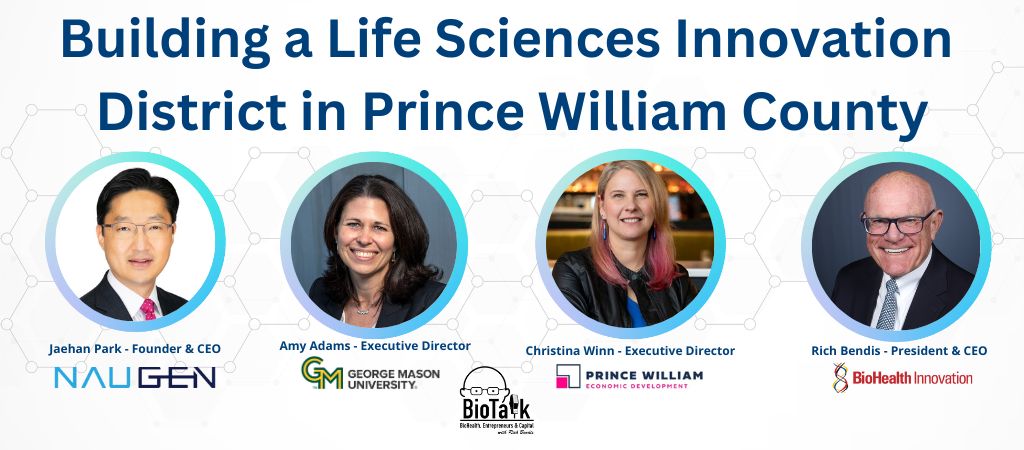

Read MoreBuilding a Life Sciences Innovation District in Prince William County on BioTalk

This episode of the BioTalk with Rich Bendis Podcast brings together leaders from industry, academia, and economic development to unpack the vision behind a…

Read MoreSamsung Biologics Expands U.S. Manufacturing Capabilities with Strategic Acquisition of Human Genome Sciences from GSK

INCHEON, South Korea, ROCKVILLE, Md. and LONDON , Dec. 21, 2025 /PRNewswire/ -- Samsung Biologics (KRX: 207940.KS), a leading contract development and manufacturing organization (CDMO), today announced…

Read MoreBHI EIR Insights: 7 Tactics to Optimize Launch Messaging – Part II

by Jonathan Kay, MPP, Managing Partner, Health Market Experts & BioHealth Innovation, Inc. Entrepreneur-in-Residence Last week, we introduced our series, Optimizing Launch Messaging. We…

Read More